BlackBull Markets Test und Erfahrungen

Zuletzt aktualisiert am Mai 10, 2023

75-90% der Privathändler/innen verlieren Geld beim Handel mit Devisen und CFDs. Deshalb sollten Sie sich überlegen, ob Sie die Funktionsweise von CFDs und gehebeltem Handel verstehen und ob Sie sich das hohe Risiko, Ihr Geld zu verlieren, leisten können. Wir erhalten möglicherweise eine Vergütung, wenn Sie auf Links zu Produkten klicken, die wir bewerten. Lesen Sie bitte unsere Angaben zur Werbung. Mit der Nutzung dieser Website stimmen Sie unseren Allgemeinen Geschäftsbedingungen zu.

Unsere Meinung zu BlackBull Markets

Founded in New Zealand in 2014, BlackBull Markets is an ECN-only broker that offers trading on a limited number of assets compared to most other brokers, including Forex, commodities, and indices.

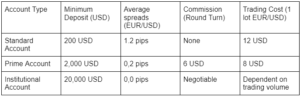

While BlackBull Markets offers a range of accounts for beginners and more experienced traders, trading costs are higher than those of other brokers on its entry level commission-free account, with average spreads of 1.2 pips on the EUR/USD. Trading costs improve on its Prime and Institutional Accounts, with spreads down to 0.1 pips (EUR/USD), but this is in addition to a commission and high minimum deposit requirements of 2,000 USD and 20,000 USD respectively.

BlackBull Markets provides direct market access on the MT4 and MT5 trading platforms and offers a number of useful trading tools, including a VPS service, FIX API and copy trading through third-party providers Zulutrade and Myfxbook Autotrade, but these are available at an additional cost.

Finally, BlackBull Markets’ educational and market analysis materials are limited compared to most other brokers, forcing traders to self educate elsewhere, but unlike most other brokers it offers personalised customer service.

| 🏦 Min. Einzahlung | USD 0 |

| 🛡️ Geregelt durch | FMA, FSA-Seychelles |

| 💵 Handelskosten | USD 8 |

| ⚖️ Max. Hebelwirkung | 500:1 |

| 💹 Copy Trading | Ja |

| 🖥️ Platforms | MT4, MT5, WebTrader |

| 💱 Instrumente | Commodities, Kryptowährungen, Energien, Forex, Indices, Metalle, Stock CFDs |

Gesamtübersicht

Kontoinformationen

Handelskonditionen

Unternehmensangaben

Pro

- Enge Spreads

- Gut für Anfänger

- Große Auswahl an Anlagen

- Excellent customer support

Nachteile

- Teure Rücknahmen

- High minimum deposits

Is BlackBull Markets Safe?

Yes, BlackBull Markets is a safe broker to trade with.

Blackbull Markets was founded in Auckland, New Zealand in 2014 and has expanded its international presence in recent years, with support offices located in London, New York, Kuala Lumpur, Hong Kong, and Japan. BlackBull Markets has regulatory oversight from New Zealand’s Financial Markets Authority (FMA) and the Seychelles Financial Services Authority (FSA):

- Black Bull Group Limited is a registered Financial Services Provider (FSP403326) and holds a Derivative Issuer Licence issued by the Financial Markets Authority of New Zealand.

- BBG Limited is incorporated and regulated by the Financial Services Authority (FSA) of Seychelles

Deutschs will be trading under the subsidiary, BBG Limited, which is authorised and regulated by the Financial Services Authority (FSA) Seychelles. The level of protection offered by the FSA is low compared to regulators such as the FCA and ASIC, and CFD brokers registered with the FSA are required to segregate client money from company operational capital, but are not required to offer negative balance protection, and have no leverage restrictions.

While BlackBull Markets keeps all client funds in segregated tier one bank accounts, clients are not offered negative balance protection. BlackBull Markets also offers leverage of up to 500:1, which means that if a client gets stopped out, they could lose more than the balance in their trading account, thereby falling into a negative balance.

Deutsch traders can, however, choose to trade under the subsidiary, BlackBull Group Limited, authorised and regulated by the FMA, but this requires a more arduous registration process, where clients are required to have all their documents notarized and certified. The FMA is a much stricter regulator than the FSA, ensuring that all client funds are held in segregated accounts, that brokers offer their clients negative balance protection, and that brokers are audited on a regular basis.

Overall, although the FSA’s regulatory oversight is weak compared to other brokers, BlackBull Markets is regulated by top-tier regulator, the FMA, and has a track record of responsible behaviour. Additionally, Deutsch traders can choose to be regulated under the FMA.

Trading Fees

BlackBull Markets’ fees are higher than most other brokers.

BlackBull Markets offers three trading accounts with higher minimum deposits linked to tighter spreads. The Standard Account’s trading costs are included in the spread, while the ECN Prime and Institutional accounts offer tighter spreads in exchange for a commission per lot. For more on BlackBull’s account types, click here.

Unfortunately, BlackBull Markets does not publish its average spreads for all instruments, and traders can only find this information by opening a demo account.

BlackBull Markets’ accounts were assessed to compare the costs to those of other brokers. The costs were evaluated based on the trading fees on one lot (100 000 USD) on the EUR/USD, including the spreads and commission.

When making this calculation, we used one lot of EUR/USD as a benchmark as it is the most commonly traded currency pair and it usually has the tightest spread.

Trading Cost Formula: Spread x Trade Size + Commission = Cost in Secondary Currency (USD):

As you can see from the table above, the trading costs on the Standard Account are built into the spread and are higher than the costs on the commission-based Prime and Institutional accounts. However, the minimum starting deposits on both the Prime and Institutional accounts make them inaccessible to most traders, particularly beginners.

Overall, BlackBull’s trading costs are higher than average on its Standard Account, and marginally lower than average on its Prime Account. The cost of trading at most other good brokers tends to be 9 USD per lot of EUR/USD. Additionally, the high minimum deposit on the Prime and Institutional Accounts makes them inaccessible to most traders.

Swap Fees

Another important cost to consider is the swap rate charged on positions held overnight. Unlike other brokers, BlackBull Markets does not publish the swap fees alongside the instruments on its website, and these have to be accessed by opening a demo account.

For example, the current swap rates on the EUR/USD are -3.1625 for a long position and 1.53 on a short position, which is in line with what is charged at other brokers.

An example of BlackBull’s swap fees can be found using the following calculation:

Daily swap charge = (one pip/exchange rate) x (trade size x tom next charge)

So in the case of going long on one lot of EUR/USD with an account base currency in EUR, the following data can be used:

- One pip: 0.00001

- Account base currency: EUR

- Exchange rate: 1.1290

- Trade size: 1 lot (100 000 EUR)

- BlackBull’s EUR/USD long swap rate: -3.1625

- BlackBull’s EUR/USD short swap rate: +1.53

Swap value to be debited from the account= (0.00001/1.1290) x (100 000 x -3.1625) = 2,80 EUR

Using the same data on a short position on one lot of EUR/USD, you would receive 1.355 EUR

Although swap fees do fluctuate with the rising and falling interest rates, this is no excuse for BlackBull not to publish its average swap fees on the most popular instruments.

Overall, although the Standard Account has a reasonable minimum deposit requirement, the ongoing costs on this account are higher than average. In contrast, although the trading costs on the Prime and Institutional accounts are below the industry average, the minimum deposit requirements put them out of the reach of most beginner traders.

BlackBull Markets’ Non-trading Fees

BlackBull Markets charges high non-trading fees compared to other similar brokers, including currency conversion fees and fees for withdrawals.

Some of the most overlooked trading costs are the non-trading fees that are charged by brokers. These fees can significantly affect your profitability and so should be carefully scrutinised.

BlackBull Markets does not charge any fees for deposits, but it charges 5 USD per withdrawal via credit cards, ewallets, and bank transfer, which is higher than other similar brokers (click here for more on BlackBull Markets’ deposits and withdrawals). In addition, there is a 5% fee if you deposit and withdraw without trading.

BlackBull Markets also charges an extraordinarily high currency conversion fee of up to 2% for withdrawals into a currency that is different from that of the trading account (click here for more on trading account currencies).

On a positive note, BlackBull Markets does not charge any inactivity fees on dormant accounts.

Overall, BlackBull Markets’ non-trading fees are higher than those of other similar brokers.

Opening an Account at BlackBull Markets

The account opening process at Blackbull Markets is user-friendly and fully digital and accounts are ready for trading within one day.

All Deutsch residents are eligible to open an account at BlackBull Markets, as long as they meet the minimum deposit requirements. These are:

- Standard Account: 200 USD

- Prime Account: 2,000 USD

- Institutional Account: 20,000 USD

BlackBull Markets offers individual, joint, and corporate accounts, but we will focus on opening an individual account:

- New traders will have to click on the “Sign Up” button at the top of the page where they will be directed to register an account.

- BlackBull Markets’ intake form requires clients to fill in their personal details (including name, country of residence, email address, birth date).

- Next traders need to select the account type (e.g. Standard or Prime), their preferred account base currency (click here for more on BlackBull Markets’ base currencies), and leverage.

- BlackBull Markets requires at least two documents to accept you as an individual client:

- Proof of Identification – BlackBull accepts all government-issued identification documents such as Passport, national ID card, driving license, or other government-issued ID.

- Proof of Address – Proof of residence/address document must be issued in the name of the BlackBull Markets’ account holder within the last 6 months and must contain a trader’s full name, current residential address, issue date, and issuing authority.

- After the application is approved, traders can login and fund their accounts

- We advise that you read BlackBull Markets’ risk disclosure, customer agreement, and terms of business before you start trading.

Overall, BlackBull Markets’ account-opening process is fully digital and hassle-free and are generally ready for trading within one business day.

BlackBull Markets’ Account Types

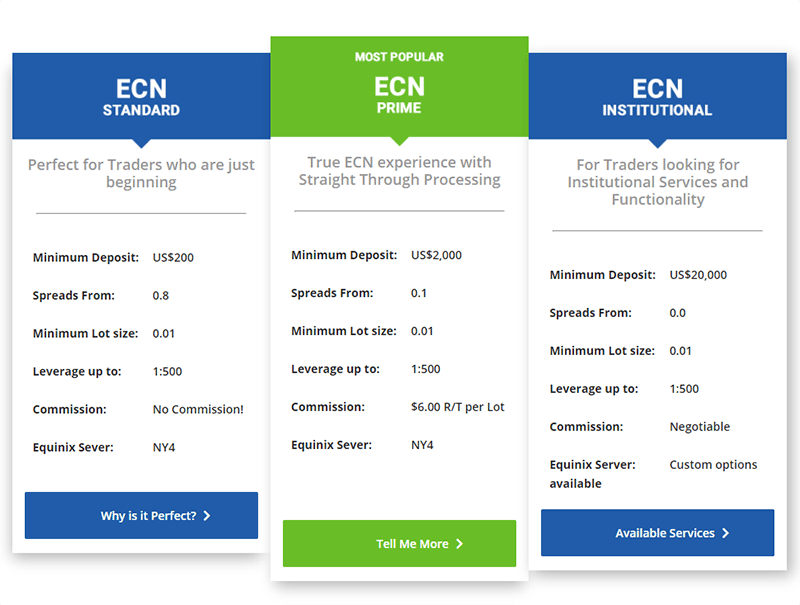

BlackBull Markets offers three account types, which is average compared to most other brokers, and its accounts are suitable for beginners and more experienced traders.

BlackBull offers three live accounts, a commission-free Standard Account with a lower minimum deposit and costs included in the spread, and two commission-based accounts with high minimum deposits, but tighter spreads.

BlackBull Markets’ accounts are suitable for both beginners and more experienced traders. We define beginner traders as inexperienced traders who have never traded before or have been trading for less than a year. Beginners often do not want to risk trading large sums of money, and will generally not be able to trade full-time during the workweek. BlackBull Markets’ Standard Account has a reasonable minimum deposit requirement of 0 USD, and it allows trading in micro-lots, making it appealing to beginners.

BlackBull Markets’ accounts are also suitable for more experienced traders. Experienced traders generally prefer paying higher minimum deposits and a commission per trade in exchange for tighter spreads. The Prime and Institutional accounts have high minimum deposits, but reasonable commission structures and tighter spreads.

BlackBull Markets operates a non-Dealing Desk (NDD) policy and its Equinix servers are based in New York (NY4), London (LD5), and Tokyo (TY3) which allow for almost instantaneous market access. It also has a number of liquidity providers (although none of the staff could provide information on how many they have nor who these liquidity providers are) to ensure competitive pricing. Generally, the more liquidity providers a broker has, the lower the spreads on their accounts. Additionally, BlackBull Markets allows all trading strategies, including hedging, scalping, and algorithmic trading, and all accounts are available as Islamic swap-free options.

BlackBull frequently mentions in its marketing literature that spreads on Forex pairs are as low as 0.1 pips but does not publish average spreads on its website.

Standard Account

The commission-free ECN Standard Account has a minimum deposit of 0. Costs are included in its variable spreads averaging at 1.2 pips (EUR/USD), which is higher than the industry average. Leverage on this account is up to 500:1 and trading is offered in micro-lots, making this account suitable for beginner traders.

Prime Account

The ECN Prime Account has a minimum deposit of 2000 USD and spreads start at 0.2 pips (EUR/USD). A commission of 6 USD round-turn is charged. Leverage is also up to 500:1 and micro-lot trading is available.

Institutional Account

This institutional account has a minimum deposit of 20,000 USD and spreads starting from 0.0 pips (EUR/USD). This account is specifically for professional traders and commission is negotiable. Institutional traders also have access to 24/6 dedicated technical support and access to the customised MAM/PAMM platforms.

Islamic Accounts

As paying or receiving interest is prohibited in Islam, BlackBull Markets have created swap-free accounts that operate in full compliance with Sharia Law. Islamic (swap-free) accounts are offered as a variant of the Standard, Prime, and Institutional Accounts, retaining all the features of the regular account types.

Overall, BlackBull Markets offers a range of accounts with different benefits to suit traders of all experience levels. However, the spreads on its commission-free account are higher than average, and the minimum deposits on its commission-based accounts make them inaccessible to most traders.

Deposits and Withdrawals

BlackBull Markets offers a range of funding methods, and while deposits are free, it charges high withdrawal fees.

A well-regulated broker, BlackBull Markets does not process payments to third parties. All withdrawal requests from a trading account must go to a bank account or a source in the trader’s name.

Deposits can be made via credit cards/debit cards, e-wallets (Skrill and Neteller), and bank transfers. Credit cards/debit cards and e-wallets are processed instantly, but deposits via wire transfer can take 3 bank days to reflect. No commissions are charged on deposits, but BlackBull Markets charges high withdrawal fees for most methods:

- Bank Wire: Deposits are free of charge and take 1-3 days to process, but a 20 USD fee is applied for withdrawals to international bank accounts and processing can take 3-5 business days.

- Visa/Mastercard: Deposits are free of charge and instant, but withdrawals incur a 5 USD fee and can take 3-5 business days to process. You can only withdraw funds to a credit card up to a maximum of your original deposit. Any profits or additional funds must be withdrawn by bank transfer.

- Skrill/Neteller/fasapay/China Union Pay: Deposits are free of charge and instant, but withdrawals incur a 5 USD fee and can take 3-5 business days to process. You can only withdraw funds to a Skrill/Neteller account up to a maximum of your original deposit. Any profits or additional funds must be withdrawn by bank transfer. Note that the Skrill account is a USD-only account, which means that traders will be charged a currency conversion fee for depositing in other currencies.

BlackBull Markets also reserves the right to charge fees at their discretion after a certain threshold, though what this threshold is and what fees may be charged are not made clear.

Overall, while BlackBull markets offers a wide range of funding methods, and deposits are free, its withdrawal fees are high.

Base Currencies (Trading Account Currencies)

BlackBull Markets offers a wider range of base currencies than most other brokers, including accounts denominated in AUD.

BlackBull Markets offers trading in nine different base currencies, including USD, EUR, GBP, AUD, NZD, SGD, CAD, JPY, and ZAR.

While most Deutschs will prefer to have their trading accounts denominated in AUD, some traders may want to have multiple accounts with different base currencies to avoid paying conversion fees. The wide range of base currencies available at BlackBull Markets makes this possible.

However, traders should be aware that some payment methods, such as Skrill only allow deposits to be made in USD, and as mentioned previously, BlackBull Markets charges a 2% currency conversion fee, which is much higher than other brokers.

BlackBull Markets’ Trading Platforms

BlackBull Markets’ trading platform support is average compared to most other brokers.

BlackBull Markets offers full support for Metatrader 4 and Metatrader 5, some of the world’s most popular trading platforms. The benefit of BlackBull Markets offering third-party platforms such as MT4 and MT5 is that traders can use their own customised versions of the platforms should they choose to migrate to another broker. However, some brokers offer their own proprietary platforms which are generally more beginner-friendly and easier to set up.

Both platforms are optimised for Windows, and include real-time market quotes and live charts on financial data, along with extensive coverage of breaking financial news, and analytics. MT4 and MT5 are available for Windows, Macs, Android, iOS, and web browser.

MetaTrader 4

Developed by MetaQuotes in 2002, MT4 is still considered one of the best CFD trading platforms in the world. Although the platform feels somewhat outdated, it is still widely recognised for its execution speeds, excellent charting tools, algorithmic trading, and customisability. Other features of MT4 include:

- The creation, modification, and utilisation of automated trading strategies.

- MQL4 programming language.

- Algorithmic trading, which allows any trading strategy to be formalised and implemented as an Expert Advisor.

- Allows traders to develop their own custom indicators.

- Multiple order types

- Market Watch Window

- Navigator Window

- Analysis features

MetaTrader 5

The MT5 trading platform is being adopted by more Forex brokers all the time. It has a more modern interface, allows for an unlimited number of charts to be used, shows Depth of Market, and has a built-in Economic Calendar. It also has a larger number of pending order types than MT4 and features an embedded chat system. The MQL5 scripting language is more efficient than its precursor, and MT5 has more advanced charting tools than MT4.

Features include:

- 38+ preinstalled technical indicators

- 44 analytical charting tools

- 21 timeframes

- Additional pending order types

- Detachable charts

Overall, BlackBull Markets’ platform support is about average when compared to other brokers, Additionally, MT4 and MT5 are generally more difficult to set up and are less user-friendly than the proprietary platforms available at some other brokers.

BlackBull Markets’ Mobile Apps

BlackBull Markets’ mobile trading platforms are average when compared to other similar brokers

Both trading platforms are available on both Android and iOS mobile devices and tablets. Beginner traders should be aware that there is some loss in functionality when compared to the desktop trading platforms, including reduced timeframes and fewer charting options. However, the MT4 and MT5 apps allow traders to work from anywhere, with functionality to close and modify existing orders and calculate profit/loss in real-time.

Overall, BlackBull’s mobile trading support is about average when compared to other brokers, with no additional support or apps apart from the trading platform’s own mobile applications.

BlackBull Markets’ Trading Tools

BlackBull Markets’ trading tools are slightly limited compared to what is offered at other similar brokers and most tools have an additional cost.

BlackBull Markets offers a free VPS service for clients with Prime Accounts and FIX API for institutional clients who want to connect directly to BlackBull’s ECN grid. It also offers a copy trading service through two third-party providers, Zulutrade and myfxbook Autotrade, which are available at an additional cost. According to customer service, BlackBull Markets is also looking at providing its clients with free access to Trading View, an excellent analytics tool, in the near future.

VPS

BlackBull Markets’ VPS service is available through third-party providers, NYC servers, and Beeks Fx. These services require a monthly subscription fee, but for traders who open a Prime Account with a minimum deposit of 2,000 USD and trade 20 lots per month, the subscription fee is waived.

BlackBull Market’s VPS hosting allows traders to run automated algorithmic strategies, including expert advisors 24 hours a day 7 days a week on a virtual machine. VPS services have the advantage of never suffering connectivity issues and have extremely low latency due to their proximity to major international exchanges.

FIX API

FIX is the coding protocol used to place trader’s orders live on the market and MT4 is the FIX application that BlackBull Markets uses. However, some traders require the use of their own FIX application, and for this purpose, BlackBull Markets offers a FIX API. FIX API allows institutional clients to bypass the BlackBull MT4 application and connect directly to the ECN grid using their own FIX. It essentially allows low latency trading and faster trade execution speeds.

Zulutrade

Zulutrade, a third-party platform, is a peer-to-peer social trading application where traders can choose among thousands of registered traders from 192 countries. Traders are ranked using “ZuluRank” according to a number of different metrics, including their overall performance, stability, maturity, exposure, and minimum equity required.

BlackBull Markets has a partnership programme with Zulutrade, and traders will have to contact Zulutrade directly to find out about the costs associated with the service.

Myfxbook Autotrade

Myfxbook is one of the most popular social trading sites on the market. It allows users to share, analyse, track and compare their trading activities between peers. It also allows users to set up auto-trading to follow traders that they have selected, in addition to setting yourself up as the main trader in an auto trading network. Myfxbook is an affiliate of BlackBull Markets, as such, the MetaTrader 4 trading program is completely integrated with the Myfxbook system.

As with the Zulutrade platform, clients will have to contact Myfxbook directly to find out about the costs of using the service.

Overall, BlackBull Markets’ trading tools are slightly underwhelming compared to what is on offer at other brokers, but the addition of Trading View will be a welcome development.

BlackBull Markets’ Financial Instruments

The choice of financial assets offered by BlackBull Markets is very limited compared to other similar brokers, but it offers over 250 share CFDs through its FMA subsidiary.

BlackBull Markets’ range of financial instruments for CFD trading (click here for more details on CFD trading), include Forex, commodities, and indices:

- Forex: BlackBull Markets only has 27 currency pairs available for trading which is much fewer than the industry average. These include majors (EUR/USD, GBP/USD, and USD/JPY) and minors (NZD/CAD, EUR/JPY, and USD/ZAR). The leverage on Forex pairs is up to 500:1.

- Indices: There are only 6 indices available for trading at BlackBull Markets, which is fewer than are available at other similar brokers. The most popular indices are those that combine the shares of some of the largest and globally acknowledged companies. Leverage is up to 1:100 on indices.

- Commodities: BlackBull Markets offers trading on 4 commodities, which is extremely limited compared to other brokers. Most other brokers offer between 5 and 10 commodities. Commodities include metals such as gold and silver and energies such as oil. The leverage is up to 500:1 on commodities.

Overall, BlackBull Markets presents one of the most limited ranges of financial instruments in the industry. However, traders can access over 250 share CFDs through its FMA subsidiary.

BlackBull Markets for Beginners

BlackBull Markets is relatively poor for beginners with a brief education section and infrequent market analysis.

Educational Material

BlackBull Markets’ educational materials are limited compared to other brokers, and the materials are neither in-depth nor comprehensive.

The educational material at BlackBull is divided into three sections: Trading Videos, Trading Guides, and a Trading Glossary.

Trading Videos: This is a small collection of 11 videos, each only a few minutes long, mainly focused on MT4 and how to use its features. Videos include Support and Resistance in MT4, Crosshairs, and Pips in MT4, and Candlestick and Timeframes in MT4. These are well summarised but are focused on traders who already understand the terminology.

Trading Guides: The trading guides are just brief explanations of important aspects of Forex trading. Titles include Avoid These 5 Common Trading Mistakes, What is a Support Level, What are Swaps and What is a Japanese Candlestick? While these are important factors to cover in Forex trading, a more structured and detailed guide would be more useful for beginners.

Trading Glossary: As you may expect, this is a list of the common terms you will read and hear when trading Forex.

Overall, the education section could be improved with a greater variety of materials in addition to providing sections for beginner and more experienced traders. Beginner traders would also benefit greatly from being able to attend webinars on CFD trading basics and risk management.

Analysis Material

BlackBull Markets offers a limited selection of market analysis materials compared to other brokers.

Like its approach to educational content, BlackBull Markets offers little in the way of market analysis. A member of the BlackBull Markets team updates a market review blog most days, focussing on specific assets or markets. A look at the week ahead is also compiled and presented every Monday.

Like most other brokers, BlackBull Markets also provides an economic calendar with the dates and times of economic news releases.

Customer Support

BlackBull Markets offers live customer support 24/5 via live chat. Email and telephone support are only available 10:00-23:00 NZT (22:00 – 11:00 GMT).

BlackBull’s telephone support is excellent – after having spoken extensively to customer support through the live chat feature, a senior employee at BlackBull Markets called to ensure that we were satisfied with their service. We found this personalised support a welcome development in an industry where the client is usually just another number on the books.

Overall, the customer support is responsive, polite, and knowledgeable.

Evaluation Method

We value transparency and openness in the way we review the partners. To bring transparency to the forefront, we have published our review process that includes a detailed breakdown of the BlackBull Markets offering. Central to that process is the evaluation of the reliability of the broker, the platform offering of the broker and the trading conditions offered to clients, which are summarised in this review. Each one of these is graded, and an overall score is calculated and assigned to the broker.

Risk Statement

Trading Forex is risky, and each broker is required to detail how risky the trading of Forex CFDs is to clients. BlackBull Markets would like you to know that: Trading foreign exchange on margin carries a high level of risk and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to trade foreign exchange, you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and, therefore, you should not invest money you cannot afford to lose. You should make yourself aware of all the risks associated with foreign exchange trading and seek advice from an independent financial advisor if you have any questions or concerns as to how a loss would affect your lifestyle.

Overview

BlackBull Markets is a New Zealand-based ECN-broker established in 2014 that offers trading on a limited number of tradable assets, including Forex, commodities, and indices. While trading costs are higher than average on its entry-level accounts, they improve significantly on its commission-based accounts, but this is in exchange for very high minimum deposits. Trading is offered on the MT4 and MT5 platforms, and BlackBull offers a number of trading tools, but these are available at an additional cost. Education and market analysis are also poor compared to other brokers, and withdrawals are relatively expensive. Overall, although BlackBull markets caters to beginners and more experienced traders, its focus is on its institutional clients.

Redaktionsteam

Chris Cammack

Leiter Inhalt

Chris kam 2019 zum Unternehmen, nachdem er zehn Jahre lang in den Bereichen Forschung, Redaktion und Design für politische und finanzielle Publikationen tätig war. Aufgrund seines Werdegangs kennt er sich mit den internationalen Finanzmärkten und der Geopolitik, die sie beeinflusst, bestens aus. Chris hat ein scharfes Auge für die Redaktion und einen unersättlichen Appetit auf aktuelle finanzielle und politische Themen. Er gewährleistet, dass unsere Inhalte auf allen Seiten die Qualitäts- und Transparenzstandards erfüllen, die unsere Leser/innen erwarten.

Alison Heyerdahl

Senior Finanzredakteurin

Im Jahr 2021 kam Alison als Autorin zum Team. Sie hat einen medizinischen Abschluss mit Schwerpunkt Physiotherapie und einen Bachelor in Psychologie. Ihr Interesse am Forex-Handel und ihre Liebe zum Schreiben hat sie jedoch dazu gebracht, den Beruf zu wechseln. Sie verfügt nun über mehr als acht Jahre Erfahrung in der Forschung und Inhaltsentwicklung. Bislang hat sie über 100 Broker getestet und bewertet und kennt die Welt des Forex-Handels in- und auswendig.

Ida Hermansen

Finanzredakteurin

2023 kam Ida als Finanzredakteurin zu unserem Team. Sie hat einen Abschluss in Digitalem Marketing und einen Hintergrund in Content Writing und SEO. Zusätzlich zu ihren Marketing- und Schreibfähigkeiten interessiert sich Ida auch für Kryptowährungen und Blockchain-Netzwerke. Ihr Interesse am Krypto-Handel führte zu einer größeren Faszination für die technische Analyse von Devisen und Preisbewegungen. Sie entwickelt ihre Fähigkeiten und Kenntnisse im Forex-Handel ständig weiter und beobachtet genau, welche Forex-Broker die besten Handelsbedingungen für neue Händler/innen bieten.

Broker vergleichen

Finden Sie heraus, wie BlackBull Markets im Vergleich zu anderen Brokern abschneidet.