ETX Capital Test und Erfahrungen

| 🏦 Min. Einzahlung | GBP 100 |

| 🛡️ Geregelt durch | FCA, FSCA, CySEC |

| 💵 Handelskosten | USD 6 |

| ⚖️ Max. Hebelwirkung | 30:1 |

| 💹 Copy Trading | Ja |

| 🖥️ Platforms | MT4, ETX |

| 💱 Instrumente | Anleihen, Commodities, Kryptowährungen, Stock CFDs, Forex, Indices |

Zuletzt aktualisiert am Mai 8, 2023

75-90% der Privathändler/innen verlieren Geld beim Handel mit Devisen und CFDs. Deshalb sollten Sie sich überlegen, ob Sie die Funktionsweise von CFDs und gehebeltem Handel verstehen und ob Sie sich das hohe Risiko, Ihr Geld zu verlieren, leisten können. Wir erhalten möglicherweise eine Vergütung, wenn Sie auf Links zu Produkten klicken, die wir bewerten. Lesen Sie bitte unsere Angaben zur Werbung. Mit der Nutzung dieser Website stimmen Sie unseren Allgemeinen Geschäftsbedingungen zu.

Unsere Meinung zu OvalX

NOTE: Currently, ETX Capital does not accept traders from Deutschland. As a replacement we recommend Pepperstone as a strong ASIC regulated broker, or eToro as the leading social trading broker in Deutschland.

ETX Capital is an FCA and FSCA-regulated broker with a feature-rich proprietary trading platform and a large range of tradable assets. With its highly customisable trading platform and 5000 share CFDs, ETX Capital is a good option for experienced traders or serious beginners looking to trade other assets than Forex.

ETX Capital offers full support for MT4 as well as its own award-winning proprietary platform, TraderPro. Unlike many proprietary platforms, TraderPro caters to both beginners and experienced traders and features numerous technical indicators, multiple chart types, split charting, highly customisable workspaces, and easy-to-use risk management tools.

Some traders may be disappointed at the lack of account options at ETX Capital, which has a single live commission-free account. Trading costs are average compared to other market maker brokers, with a minimum deposit of 100 USD and variable spreads averaging between 0.8 to 1.1 pips on the EUR/USD. Apart from share CFDs, ETX Capital offers trading on 60+ Forex pairs, cryptocurrencies, indices, commodities, and bonds – excellent for traders who wish to diversify their trading strategy.

ETX Capital also offers a wide range of educational materials for advanced traders, including regular courses run by professionals who have had successful careers as traders and senior managers at top financial institutions.

| 🏦 Min. Einzahlung | GBP 100 |

| 🛡️ Geregelt durch | FCA, FSCA, CySEC |

| 💵 Handelskosten | USD 6 |

| ⚖️ Max. Hebelwirkung | 30:1 |

| 💹 Copy Trading | Ja |

| 🖥️ Platforms | MT4, ETX |

| 💱 Instrumente | Anleihen, Commodities, Kryptowährungen, Stock CFDs, Forex, Indices |

Gesamtübersicht

Kontoinformationen

Handelskonditionen

Unternehmensangaben

Pro

- Enge Spreads

- Tolle Plattformauswahl

Nachteile

- Schlechter Service für Kunden

Is ETX Capital Safe?

ETX Capital is the trading name of Monecor London Limited, a UK-based financial services company founded in 1965 and listed on the London Stock Exchange. It is regulated by the Financial Conduct Authority of the UK (FCA), the Cyprus Securities and Exchange Commission (CYSEC), and recently, the South African Financial Sector Conduct Authority (FSCA). See below for its list of registered companies:

- Monecor (London) Ltd is authorised and regulated by the FCA license number: 124721.

- Monecor (Europe) Ltd is authorised and regulated by CySEC, license: 096/08.

- Monecor Ltd is authorised and regulated by the FSCA under license number 50246.

Global traders will be trading under the subsidiary, Monecor (London) Ltd, authorised and regulated by the FCA in the United Kingdom. Known as one of the strictest regulators in the world, the FCA ensures that brokers segregate all client funds, offer clients negative balance protection and that brokers regularly submit externally audited statements.

In line with the strict regulatory environment under which ETX Capital operates, all client funds are kept segregated from operational accounts and all Malaysian traders will have negative balance protection. It is also insured by the Financial Services Compensation Scheme (FSCS). In the event of liquidation, clients may be compensated by the FSCS up to a limit of 85,000 EUR per person.

ETX Capital has won multiple awards for its trading tools, trader education, and platform. Recent awards include Best Forex Trading Support – Europe 2020 (Global Forex Awards), Best Mobile/Tablet Application 2020 (Shares Awards), Best Trading Education 2019 (Shares Awards), Best Trading Tools 2019 (Online Personal Wealth Awards), and Best Online Trading Platform 2018 (Shares Magazine) for the ETX TraderPro proprietary trading platform.

As a long-established, publicly-listed financial company with strict regulation and frequent industry recognition, we deem ETX Capital a safe broker.

Trading Fees

ETX’s trading fees are average compared to other similar brokers.

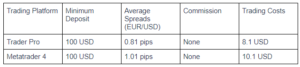

Unlike other brokers that offer a range of accounts with higher minimum deposits linked to tighter spreads, ETX Capital offers a single live account on two different platforms (click here for more on ETX Capital’s trading platforms). Trading conditions vary depending on the platform chosen.

ETX Capital’s accounts were assessed to compare the costs to those of other forex brokers. The costs were evaluated based on the trading fees on one lot (100 000 USD) on the EUR/USD, including the spreads and commission.

When making this calculation, we used one lot of EUR/USD as a benchmark as it is the most commonly traded currency pair and it usually has the tightest spread.

Trading Cost Formula: Spread x Trade Size + Commission = Cost in Secondary Currency (USD):

As you can see from the table above, ETX Capital’s trading costs are included in its variable spreads. Spreads widen or tighten depend on trade volume and market volatility.

The trading costs on the Trader Pro platform are lower than those on the MT4 platform and are slightly lower than the industry average. The trading costs at most other brokers tend to be 9 USD per lot of EUR/USD.

Swap Fees

Another important cost to consider is the swap rate charged on positions held overnight. Interest is paid (or received) for each night a position is held. These are the interbank market ‘tom-next’ rates plus ETX Capital’s standard fee of 1.35% per annum. Positions held overnight on a Wednesday will be subject to three days of swap charges. Unfortunately, ETX Capital does not publish these fees on its website.

Overall, ETX Capital’s trading costs are slightly lower than the industry average on the TraderPro platform but slightly higher than average on the MT4 platform.

Non-trading fees

ETX Capital’s non-trading fees are lower than other similar brokers.

ETX Capital does not charge any account, deposit, or inactivity fees. The first five withdrawals of a month are free, and a charge of 10 USD per withdrawal is charged thereafter. Additionally, traders are charged a withdrawal fee for amounts less than 100 USD.

Overall, ETX Capital’s non-trading fees are low, and fees are only charged for withdrawals under certain circumstances.

Opening an Account at ETX Capital

The account opening process at ETX Capital is user-friendly, fully digital and accounts are ready for trading within one day.

All Deutsch residents are eligible to open an account at ETX Capital but have to meet the minimum deposit requirement of 100 USD.

Creating an account is straightforward, the process is fully digital, and accounts are usually ready within one day. ETX Capital offers individual and corporate accounts, but we will focus on opening an individual account:

- New traders will have to click on the “Create an Account” button at the top of the page where they will be directed to confirm their country of residence.

- Next, traders will have to choose their preferred platform – Trader Pro or MetaTrader 4.

- ETX Capital’s intake form requires clients to fill in their personal details (including name and email address) and then create a password.

- Traders will then have to fill in their date of birth, telephone number, and ID number.

- Once this step is complete, clients are required to fill out a questionnaire that helps ETX Capital assess the trader’s investment knowledge, experience, and expertise to deem the suitability and relevance of the services on offer. While most brokers don’t include this step in the account-opening process, it is a responsible move in an industry that is often accused of an irresponsible approach to consumer protection.

- ETX Capital requires at least two documents to accept you as an individual client:

- Proof of Identification – ETX Capital accepts all government-issued identification documents such as Passport, national ID card, driving license, or other government-issued ID.

- Proof of Address – Proof of residence/address document must be issued in the name of the ETX Capital’s account holder within the last 6 months and must contain a trader’s full name, current residential address, issue date, and issuing authority.

After the application is approved, traders can login and fund their accounts We advise that you read ETX Capital’s risk disclosure, customer agreement, and terms of business before you start trading.

Overall, ETX Capital’s account-opening process is fully digital and hassle-free and accounts are generally ready for trading within one business day.

ETX Capital’s Account Types

ETX Capital offers one account type, which is limited compared to other brokers, and its account is suitable for beginners and more experienced traders.

ETX Capital is a market-maker broker offering trading on over 5000 assets, including 60+ Forex pairs, indices, shares, commodities, and cryptocurrencies (click here for more on ETX Capital’s tradable instruments).

ETX Capital offers one live commission-free account with spreads that vary depending on the platform chosen (click here for more on ETX Capital’s trading platforms). This arrangement could be a disadvantage for traders who are familiar with MT4, and will then have to pay higher trading costs. The minimum deposit requirements to open an account are 100 USD.

The low minimum deposit requirement on ETX Capital’s account makes it accessible to beginner traders. We define beginner traders as inexperienced traders who have never traded before or have been trading for less than a year. Beginners often do not want to risk trading large sums of money, and will generally not be able to trade full-time during the workweek.

Experienced traders generally prefer paying higher minimum deposits and a commission per trade in exchange for tighter spreads, which is not available at ETX Capital. Experienced traders will, however, appreciate the tight spreads and large number of tradable assets available for trading.

Under FCA regulation, clients have a leverage limit of 30:1 on forex pairs. Clients can elect to trade as a professional, subject to certain eligibility criteria, and will then be afforded leverage of up to 286:1.

ETX allows hedging and copy trading (or algorithmic trading), but does not allow copy trading. It also does not offer Islamic swap-free accounts. See below for details on ETX Capital’s accounts:

TraderPro

Average spreads using the TraderPro platform are 0.81 pips for the EUR/USD, 1.40 for the EUR/GBP, and 1.06 for the USD/JPY, which is tighter than the industry average. The minimum deposit to open an account is 100 USD.

MetaTrader 4

Spreads are slightly wider on the MT4 platform, averaging at 1.01 pips for the EUR/USD, 1.54 pips for the EUR/GBP, and 1.35 pips for the USD/JPY. Again, the minimum deposit requirement is 100 USD.

Demo Accounts

Demo accounts are available on both platforms. The demo account is unlimited and comes loaded with virtual currency. Demo accounts are a good way to practice trading under real market conditions. We recommend opening a demo account if you decide to use TraderPro, as it is different from other popular third-party software.

Overall, although the account choice at ETX Capital is limited, the account is suitable for both beginners and more experienced traders.

Deposits and Withdrawals

ETX Capital offers an average number of payment methods compared to other brokers. Deposits are free, and fees are only charged for withdrawals under certain circumstances.

In line with Anti-Money Laundering policies, all deposits must be made from an account/card registered in your name, and ETX Capital does not accept third-party deposits.

ETX Capital does not charge for deposits, but for withdrawals under 100 USD, or currency equivalent, a 10 USD administration fee will be charged. Furthermore, ETX Capital offers each client five withdrawals for any amount over 100 EUR/GBP/USD each calendar month without a processing fee. Due to the fees incurred by ETX Capital for processing withdrawals, clients who withdraw funds more than five times in a calendar month will incur a charge of 10 EUR (or currency equivalent) for each subsequent withdrawal.

Withdrawals requested before 2 pm will be processed on the same business day, but the time that it takes to reach the client’s account varies depending on the country. Traders can expect to see withdrawals made via credit/debit cards and bank transfers within seven days and payments made via Skrill and Neteller within 24 hours. The following payment methods are accepted:

- Bankwire Transfers

- Credit card/debit cards

- Skrill

- Neteller

How do you withdraw money from ETX Capital?

- Log in to the web trading platform.

- Click on the ‘Payment’ section and select ‘Withdraw funds’.

- Enter the amount you wish to withdraw and click on ‘Proceed’.

Overall, ETX Capital provides an average number of funding methods, and while deposits and withdrawals are free, processing times are slow.

Base Currencies (Trading Account Currencies)

ETX Capital offers a limited number of base (trading account) currencies compared to other similar brokers.

Trading accounts can only be denominated in three base currencies – EUR, USD, and GBP, which is limited compared to other brokers. Most other brokers denominated accounts in at least five to ten currencies. Additionally, ETX Capital does not offer AUD trading accounts, which is a disadvantage for Deutschs who will likely have bank accounts denominated in AUD, and who will have to pay currency conversion fees on deposits and withdrawals.

For traders that trade in large volumes (more than 10 lots a month), it is better to open an account denominated in USD at a digital currency bank, especially for trading on assets such as the EUR/USD. This is because when trading a USD quoted currency pair with an AUD account, there will be a small conversion fee for every trade made.

Overall, ETX Capital offers fewer trading account currencies than most other large international brokers and doesn’t offer accounts denominated in AUD.

Trading Platforms

ETX Capital’s trading platform support is average compared to most other brokers.

ETX offers trading on MetaTrader 4 and its own proprietary trading platform, Trader Pro. Winner of numerous awards, the ETX TraderPro software was designed for experienced traders with advanced charting, and numerous drawing and risk-management tools.

A popular third-party trading platform, MT4 is available for those already familiar with the platform, but includes the ETX MT4 Remastered upgrade, consisting of numerous add-ons and improvements.

Trader Pro

Trader Pro is ETX Capital’s proprietary platform. It is user-friendly and highly customisable. The customized workspaces ensure individual flexibility, a feature that more and more clients demand from a competitive trading platform.

Features of the ETX TraderPro include:

- Eight chart types, including Classic Candle Stick, Heikin Ashi, and the Ichimoku Cloud.

- Split charting tools (with eight time frames and individual indicators)

- Over 60 trend-following indicators

- Numerous drawing tools

Furthermore, its easy-to-use trade tickets make it simple to set stops and limits, enabling you to calculate your risk prior to execution.

Additionally, ETX Capital provides a comprehensive selection of video tutorials to help familiarise traders with the platform. Overall, Trader Pro provides traders with an excellent trading experience.

MetaTrader 4

The MT4 platform is the most commonly used trading software in the CFD trading industry. With the ETX MT4 platform, traders can use Expert Advisors for automated trading, trade micro-lots, use MT4 hedging and one-click trading. MT4 also comes with the ETX MT4 Remastered plugin, which will be discussed below in the trading tools section.

Other features of MT4 include:

- MQL4 programming language

- Single-thread, single-currency backtesting

- 30 inbuilt technical indicators

- 31 graphical objects

- Nine timeframes

- Hedging allowed

There are also many advantages of signing up with an MT4 broker:

- The MT4 community is vast, as is the amount of text and video resources to support new and experienced traders alike.

- The MT4 EA (Expert Advisor) community of developers is very active, so renting or buying algorithmic trading software is very easy.

- MT4 has very low system requirements, and MT4 trading can run off any device.

While MT4 has great customizability, the platform feels outdated, and some of the features may be hard to find. In addition, only the basic orders are available, including Market, Limit, Stop, and Trailing Stop.

The benefit of brokers offering third-party platforms such as MT4 is that traders can take their own customised version of the platform with them should they choose to migrate to another broker.

Mobile Trading

ETX Capital’s mobile platform support is average compared to other brokers.

ETX Capital offers two mobile trading platforms, TraderPro and MetaTrader 4.

TraderPro Mobile App

A mobile version of the ETX Trader Pro software is available for Android and IOS devices. Traders have the same functionality available on the desktop version, including being able to manage positions, react to market movements, create watchlists, and place trades no matter where they are. Still, recent comments from the community suggest that the application has many glitches and that some of the main features do not work. Additionally, people complain that it constantly freezes and times out.

Metatrader 4 Mobile App

MetaTrader4 (MT4) is available on IOS, Android, and Windows mobile phones and tablets. The app will connect to the same account as the desktop software, allowing a synchronised and mobile trading experience.

Traders should be aware that there is some loss in functionality when compared to the desktop trading platforms, including reduced time frames and fewer charting options, but traders can close and modify existing orders, calculate profit and loss, and trade on the charts.

Trading Tools

ETX Capital offers fewer trading tools than other international brokers.

ETX Capital offers the MT4 Remastered and a number of trading tools integrated into the TraderPro platform as outlined above.

ETX MT4 Remastered

Designed to enhance the MT4 platform, the tool comes with numerous add-ons, including a trade terminal, a mini terminal, tick chart trader, and stealth orders. The package is available for all retail clients for free. A few of the tools are highlighted below:

- Miniterminal: Allows traders to adapt the platforms’ deal tickets and charts to their preferences with a host of highly configurable new features.

- Trade Terminal: Manage your trading account with powerful tools, create watch lists for your favourite symbols, create order templates and generate order groups for a strategic approach to pending order management.

- Session Map: A map that tracks the global financial markets and an economic calendar that offers the latest key information.

- Correlation matrix: Enables you to see how correlated your watched markets are, and limit your risk accordingly.

- Stealth Orders: Allows traders to hide entry and exit levels from the market.

Overall, the ETX MT4 Remastered is a great enhancement to the MT4 platform, but ETX Capital would do well to add more trading tools to its trading arsenal.

ETX Capital’s Financial Instruments

ETX Capital offers a wider range of tradable assets compared to other large international brokers.

ETX Capital’s range of financial instruments for CFD trading (click here for more details on CFD trading), includes Forex, share CFDs, commodities, bonds, cryptocurrencies, and indices.

- Forex: ETX Capital has over 62 currency pairs available for trading, a broader range than is available at other similar brokers, including majors (EUR/USD, GBP/USD, and USD/JPY) and minors (NZD/CAD, EUR/JPY, and USD/ZAR), and exotics. The leverage on Forex pairs is up to 30:1.

- Share CFDs: ETx Capital offers 5000 share CFDs, an impressive range compared to other brokerages, but trading is only available on the TraderPro platform. The selection available includes some of the major US, UK, and European Exchanges. Leverage on share CFDs is up to 20:1.

- Indices: A larger range than other brokerages, there are 35 indices available for trading at ETX Capital. These include the Wall Street, UK 100, Germany 30, & the SP500. Leverage is up to 1:20 on indices.

- Commodities: ETX Capital offers trading on 24 commodities, a larger range than other brokers. Commodities include metals such as gold and silver, and energies such as natural gas and oil, and softs such as wheat and cotton. Leverage is up to 1:10 on commodities.

- Bonds: There are 11 bonds available for trading, including those of the US and Europe. The maximum leverage is up to 1:5.

- Cryptocurrencies: ETX Capital offers trading on Bitcoin, crossed with EUR, GBP, and USD. This is a severely limited range compared to what is available at other brokers. Additionally, trading is only available on the MT4 platform. Leverage is up to 2:1.

Overall, ETX Capital offers a broader range of assets compared to other brokers, including an impressive Forex lineup.

Educational Material

ETX Capital’s educational materials are more comprehensive than other brokers, and it caters to both beginners and more advanced traders.

ETX Capital has invested heavily in its education and market analysis materials. With awards for Best Education 2018 (Online Personal Wealth Awards), Best Forex Education 2018 (UK Forex Awards), and Best Trading Education 2018 (Shares Magazine), newcomer traders will find the educational materials welcoming.

ETX Capital has targeted courses for different asset classes, webinars, ebooks, and platform guides. It also boasts an ETX Trading Academy, which caters to traders of all experience levels. See below for more details:

- The Learn Forex Course is a light 24-minute course designed to act as a quick starter guide to inspire new trader confidence. Other similar courses are available for learning indices, commodities, shares, and cryptocurrencies. While this course is unique in that it offers a different set of material for each asset class, the content is limited and would leave a trader familiar with the basics of Forex trading searching for new materials.

- The ETX Trading Academy is run by a third-party provider, the Corellian Academy. It provides professional and interactive financial market education for traders of all experience levels. Its mentors have all had successful careers as traders and senior managers at top financial institutions.

- ETX Capital also runs a weekly “Learn to trade like a professional Trader” webinar series. Run by market veterans, these webinars help traders gain a quick footing in the world of trading.

- Traders can take advantage of the exclusive free eBook library to learn about key trading strategies and instructions on analysing various market events.

Analysis Material

ETX Capital’s analysis materials are limited compared to other international brokers.

Limited to one blog, all analysis material that ETX Capital has to offer is open to the public. The in-house research team posts frequent analyses of both past and future events as well as a daily round-up in written format. Traders should note that because ETX Capital is a multi-asset broker, most of the analysis relates to non-currency assets.

Customer Support

Multi-lingual customer support is available 24/5 by telephone, email, and live chat. Existing clients are also provided with direct phone numbers to shorten waiting times. In our test of ETX Capital’s live chat support, agents were connected within a minute and provided relevant answers. We also enjoyed the professional tone of the customer service team. However, if you don’t respond quickly enough, the live chat closes.

Similar to live chat assistance, email support works well. We emailed ETX twice and we received relevant and helpful answers in every case.

Evaluation Method

We value transparency and openness in the way we review the partners. To bring transparency to the forefront, we have published our review process that includes a detailed breakdown of the ETX Capital offering. Central to that process is the evaluation of the reliability of the broker, the platform offering of the broker and the trading conditions offered to clients, which are summarised in this review. Each one of these is graded, and an overall score is calculated and assigned to the broker.

ETX Capital Risk Statement

Trading Forex is risky, and each broker is required to detail how risky the trading of Forex CFDs is to clients. ETX Capital would like you to know that: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 77.9% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Conclusion

Overall, ETX Capital is a trustworthy and dependable broker. Its proprietary TraderPro platform is undoubtedly one of the best in the industry, and the beginner education material on offer is world-class. Its range of financial instruments, including the broad range of Forex pairs should be enough to satisfy experienced traders. Still, the limited number of account types and average trading conditions are a bit of a disappointment.

Redaktionsteam

Chris Cammack

Leiter Inhalt

Chris kam 2019 zum Unternehmen, nachdem er zehn Jahre lang in den Bereichen Forschung, Redaktion und Design für politische und finanzielle Publikationen tätig war. Aufgrund seines Werdegangs kennt er sich mit den internationalen Finanzmärkten und der Geopolitik, die sie beeinflusst, bestens aus. Chris hat ein scharfes Auge für die Redaktion und einen unersättlichen Appetit auf aktuelle finanzielle und politische Themen. Er gewährleistet, dass unsere Inhalte auf allen Seiten die Qualitäts- und Transparenzstandards erfüllen, die unsere Leser/innen erwarten.

Alison Heyerdahl

Senior Finanzredakteurin

Im Jahr 2021 kam Alison als Autorin zum Team. Sie hat einen medizinischen Abschluss mit Schwerpunkt Physiotherapie und einen Bachelor in Psychologie. Ihr Interesse am Forex-Handel und ihre Liebe zum Schreiben hat sie jedoch dazu gebracht, den Beruf zu wechseln. Sie verfügt nun über mehr als acht Jahre Erfahrung in der Forschung und Inhaltsentwicklung. Bislang hat sie über 100 Broker getestet und bewertet und kennt die Welt des Forex-Handels in- und auswendig.

Ida Hermansen

Finanzredakteurin

2023 kam Ida als Finanzredakteurin zu unserem Team. Sie hat einen Abschluss in Digitalem Marketing und einen Hintergrund in Content Writing und SEO. Zusätzlich zu ihren Marketing- und Schreibfähigkeiten interessiert sich Ida auch für Kryptowährungen und Blockchain-Netzwerke. Ihr Interesse am Krypto-Handel führte zu einer größeren Faszination für die technische Analyse von Devisen und Preisbewegungen. Sie entwickelt ihre Fähigkeiten und Kenntnisse im Forex-Handel ständig weiter und beobachtet genau, welche Forex-Broker die besten Handelsbedingungen für neue Händler/innen bieten.

Broker vergleichen

Finden Sie heraus, wie OvalX im Vergleich zu anderen Brokern abschneidet.