InstaForex Test und Erfahrungen

Zuletzt aktualisiert am Mai 12, 2023

75-90% der Privathändler/innen verlieren Geld beim Handel mit Devisen und CFDs. Deshalb sollten Sie sich überlegen, ob Sie die Funktionsweise von CFDs und gehebeltem Handel verstehen und ob Sie sich das hohe Risiko, Ihr Geld zu verlieren, leisten können. Wir erhalten möglicherweise eine Vergütung, wenn Sie auf Links zu Produkten klicken, die wir bewerten. Lesen Sie bitte unsere Angaben zur Werbung. Mit der Nutzung dieser Website stimmen Sie unseren Allgemeinen Geschäftsbedingungen zu.

Unsere Meinung zu InstaForex

With a broad range of tradable instruments, excellent platform support, and fixed spread accounts, InstaForex appeals to traders who prefer predictable trading conditions. However, InstaForex’s trading costs are significantly higher than average across all four of its trading accounts.

A well-regulated broker, InstaForex offers trading on shares, indices, commodities, metals, energies, cryptocurrencies, futures, and over 100 Forex pairs – a much larger range than is typically available at other brokers.

InstaForex offers four live instant execution accounts, all with a minimum deposit of 1 USD. Spreads are fixed at 3 pips (EUR/USD) on its commission-free accounts and 0 pips (EUR/USD) on it’s commission-based accounts in exchange for a commission of 30 USD (round turn) per lot traded. These trading costs are significantly higher than other brokers, but don’t vary with trade volume or market volatility.

Both the MT4 and MT5 trading platforms are available, alongside two of InstaForex’s own web-based platforms. It also offers numerous trading tools, including VPS hosting services, various copy trading applications, and a number of technical analysis tools.

One drawback is that the educational materials are poorly presented and lack depth, making it a poor choice for beginner traders. However, InstaForex’s market analysis materials are detailed and frequently updated to help traders make better trading decisions.

| 🏦 Min. Einzahlung | USD 1 |

| 🛡️ Geregelt durch | B.V.I FSC, FSA-St-Vincent |

| 💵 Handelskosten | USD 30 |

| ⚖️ Max. Hebelwirkung | 30:1 |

| 💹 Copy Trading | Ja |

| 🖥️ Platforms | MT4, MT5 |

| 💱 Instrumente | Commodities, Kryptowährungen, Stock CFDs, Forex, Futures, Indices, Metalle, WTIs |

Gesamtübersicht

Kontoinformationen

Handelskonditionen

Unternehmensangaben

Pro

- Große Auswahl an Anlagen

- Copy Trading Konten

Nachteile

- Teure Rücknahmen

- Begrenzte Ausbildung

- Große Spreads

Is InstaForex Safe?

Yes, with regulation from a number of top-tier regulatory authorities, including the FCA, CySEC, and the BVI FSC, InstaForex is considered a safe broker to trade with.

Founded in 2007, InstaForex is a global CFD and binary options broker headquartered in Cyprus. A well-regulated broker, InstaForex maintains regulation from the Cyprus Securities and Exchange Commission (CySEC), the UK Financial Conduct Authority (FCA), the British Virgin Islands Financial Services Commission, and the Financial Services Commission in Saint Vincent and the Grenadines. See below for a list of registered companies:

- Instant Trading Ltd is licensed by BVI FSC (British Virgin Islands). License Number: SIBA/L/14/1082.

- Insta Service Ltd is registered with FSC Saint Vincent and the Grenadines, registration number IBC22945.

- Instant Trading EU Ltd is regulated by CySEC, licence number: 266/15.

- Instant Trading EU Ltd is regulated by the FCA, licence number: 728735.

Deutschs will be trading under the subsidiary, Instant Trading Ltd (BVI) is licensed by BVI FSC. Unlike other regulators, such as ASIC in Deutschland and the FCA in the UK, the BVI FSC does not force InstaForex to restrict leverage or to be members of a client compensation scheme. But all Deutsch client funds are held in segregated accounts with top-tier banks and InstaForex is subject to frequent audits of its finances and client operations.

In addition, all Deutsch clients have negative balance protection, meaning they can never lose more money than is held in their trading account. The firm is also a member of the International Monetary Fund, a scheme that serves to protect eligible retail clients by paying compensation in the event that a company fails to reimburse funds and/or financial instruments due to liquidity issues.

Awards

- InstaForex has received many awards over the years. Recent highlights include:

- Best Forex Broker Central and Eastern Europe 2020 (International Business Magazine)

- Best Affiliate Program 2020 (Global Brands Magazine)

- Best Forex Broker Eastern Europe 2019 (International Business Magazine)

- Best Broker in Asia 2019 (Le Fonti Awards)

- Best Forex Cryptocurrency Trading Platform 2018 (UK Forex Awards)

Traders should be aware that InstaForex offers high leverage to its clients – up to 30:1 on some of its account types. It also has very low minimum deposit requirements (1 USD), which means for traders who deposit small amounts, it will be difficult to hold a substantial trading position without getting stopped out and losing the money in their trading accounts.

Taken together, the long history of responsible behaviour, the strict banking standards, the first-class international regulation, and the industry praise, we deem InstaForex a trustworthy and safe broker. Traders should, however, be aware of trading with high levels of leverage and low minimum deposits.

Trading Fees

InstaForex’s trading fees are significantly higher than other brokers.

InstaForex offers four trading accounts all with a minimum deposit requirement of 1 USD on three different platforms, including InstaTick, Metatrader 4, and Metatrader 5 (see here for more on InstaForex’s trading platforms). InstaForex’s Standard accounts are commission-free with trading costs included in its fixed spreads, while the Insta accounts offer 0 spread trading in exchange for a commission of between 0.03% – 0.07%, depending on the instrument (for more on InstaForex’s trading accounts, click here).

InstaForex’s fee structure is transparent, and it publishes all spread and commission costs associated with each account.

InstaForex’s accounts were assessed to compare the costs to those of other brokers. The costs were evaluated based on the trading fees on one lot (100 000 USD) on the EUR/USD, including the spread and commission.

When making this calculation, we use one lot of EUR/USD as a benchmark as it is the most commonly traded currency pair and it usually has the tightest spread.

Trading Cost Formula: Spread x Trade Size + Commission = Cost in Secondary Currency (USD):

As you can see from the table above, the trading costs on all of Instaforex’s accounts are extremely high, at 30 USD per lot of EUR/USD. This is a strange move, as most other brokers offer a range of accounts with higher minimum deposits linked to tighter spreads and lower trading costs. Additionally, the trading costs at most other good brokers tend to be 9 USD per lot of EUR/USD traded.

Swap Fees

The other main trading cost to consider is the overnight swap fee. Swaps can be either positive or negative. Interest for a position carry over in a currency market is paid or deducted for every open trade at 17.00 EST (Eastern Standard Time) for every trading day. Trades opened before 17.00 EST and retained after this time are considered as carried over till the next day and are charged or credited with an interest depending on a trading position opened by the trader. For example, InstaForex charges a swap fee of -0.63 on a long position and -0.15 on a short position.

Compared to other similar brokers Instaforex’s minimum deposits are low, but the spreads and commissions charged on its accounts are significantly higher than average.

Non-trading Fees

Instaforex’s non-trading fees are higher than other similar brokers.

Some of the most overlooked trading costs are the non-trading fees that are charged by brokers. These fees can significantly affect your profitability and so should be carefully scrutinised.

InstaForex charges no fees for deposits, but it charges high withdrawal and inactivity fees. For example, a fee of 1.75% applies for withdrawals via online banking (click here for more on deposits and withdrawals). A currency conversion fee will also apply for deposits and withdrawals from bank accounts in a different currency than the trading account.

Additionally, clients are charged an inactivity fee after six months of account dormancy. Unfortunately, InstaForex does not publish these costs on its website.

Overall, Instaforex charges higher non-trading fees than other brokers.

Opening an Account at InstaForex

Opening an account at InstaForex is fully digital, hassle-free and accounts are ready for trading within 1 day.

Deutsch traders are eligible to open an account at InstaForex but will have to meet the minimum deposit requirement of 1 USD to do so.

Forex trading account registration only takes a few minutes. After registration, you will receive the welcome bonus amounting to 30% of the money you have deposited to your forex account.

The account-opening process is as follows:

- Accept the terms of the Public Offer Agreement. This agreement does not have to be signed in order to be binding – it is as legally valid as a standard paper contract.

- Fill in the special registration form. After you have completed all the fields, you will receive the following information via email:

- Your forex trading account number (login) and trader password needed to access Client Cabinet. They are also used for conducting operations via the trading platform;

- Your phone password (keyword) used when you contact InstaForex specialists from Technical Support or Dealer Department;

- Your PIN code for confirming withdrawal requests.

- Traders can start trading on the Forex market once they have deposited money into their forex trading account for the first time. However, this needs to happen within 30 days after initial account registration.

- Traders can set up a trading terminal on their PC, tablet or smartphone, and start trading.

- If your account has not been verified yet, you enjoy just 60% of all the opportunities InstaForex gives you. Although account verification is not obligatory, it provides you access to the full spectrum of the services. Accounts can be verified need by uploading a scanned copy of your passport or any other ID (on this page). Within 72 business hours after sending the document, you will receive an email confirming the status of your trading account or requesting additional documents necessary for the verification.

Overall, InstaForex’s account opening process is fully digital and hassle-free, and new traders will be pleased that they can deposit funds without waiting for account verification.

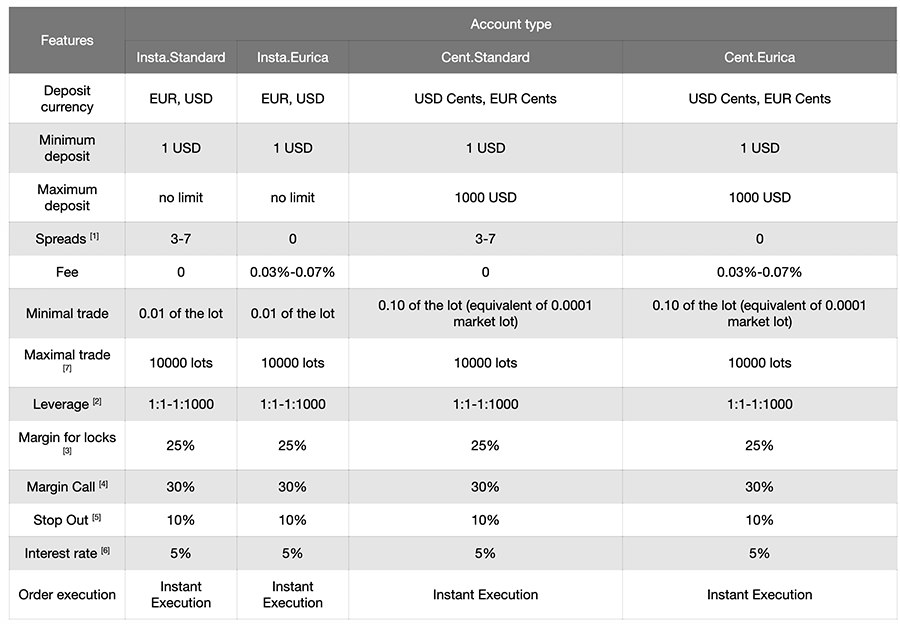

InstaForex Account Types

InstaForex has a wide range of account types, but maximum leverage is very high (up to 1:1000), which in combination with the low minimum deposits can lead to account wipeouts.

InstaForex offers CFD trading on Forex, stocks, indices, metals, commodities, and cryptocurrencies (click here for more on InstaForex’s tradable instruments).

InstaForex has four different account types suited to beginner traders. Beginner traders are inexperienced traders who have never traded before, or who have been trading for less than a year. Beginner traders often do not want to risk trading large sums of money and generally will not be able to trade full-time during the workweek.

Accounts with lower minimum deposits and which allow trading in micro-lots are generally more suited to beginner traders. However, spreads on these accounts are often wider than those with higher minimum deposits. All InstaForex’s accounts have minimum deposits of only 1 USD, and it offers two micro trading accounts.

InstaForex does not cater well to experienced traders – it does not offer higher minimum deposit accounts with tighter spreads or better trading costs.

Accounts have a maximum leverage of 30:1, spreads are fixed, and two of the accounts are commission-based. Accounts are denominated in USD and EUR, and the minimum required deposit to open an account is 1 USD. InstaForex allows copy-trading but does not allow hedging and scalping.

InstaForex offers both 4 standard live accounts and an Islamic account.

The four live account types include Insta.Standard, Insta.Eurica, Cent.Standard, and Cent.Eurica:

- Insta.Standard: This account offers commission-free trading on all asset types. Spreads start at 3.00 pips on the EUR/USD, and leverage is up to 30:1. Minimum transactions start at 0.01 lots, and Stop Out levels are at 10%. This account is further divided into three tiers depending on the minimum deposit:

- With a minimum deposit of 1-10 USD, traders will access micro-lot trading.

- With a minimum deposit of 100-1000 USD, traders will have access to Mini Lot trading.

- With a minimum deposit of 1000 USD or over, traders will have access to Standard Lot trading.

- Insta.Eurica: This account requires a minimum deposit of 1 USD and, instead of the spread, charges a mark-up fee of 0.03%. Minimum trades start at 0.01 lots and Stop Out levels are at 10%.

- Cent.Standard: This account type has the same trading terms as the Insta.Standard Account, except – as the name suggests – all trades are denominated in currency cents (1/100th of a currency unit). Because the risk is so low, we consider this a good practice account. Spreads are wide – at between 3.00 – 7 pips, leverage is 30:1, and no commissions are charged.

- Cent.Eurica: This account type has the same trading terms as the Insta.Eurica Account, except – as the name suggests – all trades are denominated in currency cents (1/100th of a currency unit). Because risk is so low, we consider this a good practice account. Spreads are fixed at 0 pips on the EUR/USD, but a round turn commission of 0.03% is charged.

- Islamic Account: All InstaForex accounts are available as Islamic Accounts, and this option can be selected at account opening.

Demo Account

InstaForex also offers a demo account with virtual funds that can be topped up on request. Demo accounts are a great way to practice trading in a risk-free environment, and it gives traders an opportunity to familiarise themselves with InstaForex’s platforms.

Deposit and Withdrawal Fees

InstaForex offers a wide range of deposit and withdrawal methods. While no fees are charged for deposits, it charges high withdrawal fees.

A well-regulated broker, InstaForex does not process payments to third parties. All withdrawal requests from a trading account must go to a bank account or a source in the trader’s name. InstaForex reserves the right to request further documentation while processing the withdrawal request or to decline a withdrawal request with a specific payment method and suggest another payment method. Instaforex reserves the right if it is not satisfied with any documentation provided by the Client, to reverse the withdrawal transaction and deposit the amount back to the Client’s Trading Account

While InstaForex offers free deposits by various methods, deposits are processed within 3 hours to 2 days. Withdrawals are also slow, and all withdrawal methods have fees attached – usually between 0.5 – 2% of the transaction. For instance, bank wire withdrawals have a 2% fee and take 2-4 days to process.

Deutsch traders can make both deposits and withdrawals via local bank transfers, though banking fees will be charged, and costs will vary depending on the bank. Other payment methods include credit cards/debit cards, payco, bitcoin, bank wire transfers, ATM transfers, and Skrill.

Overall, InstaForex offers a wide range of payment methods, but processing times are slow, and InstaForex charges high withdrawal fees.

Bonuses

InstaForex offers a variety of bonuses to its retail traders. Remember to read the fine print for all bonuses for agreeing to them. Current InstaForex bonuses available in Nigeria include:

- 100% First Deposit Bonus

- 55% Bonus on Every Deposit

- 30% Bonus on Every Deposit

- Club bonus for traders with an InstaForex club card (1% for deposits of 500 USD up to 10% for deposits of 15,000 USD)

Remarkably, profits made with the use of bonuses can be withdrawn.

Base Currencies (Trading Account Currencies)

InstaForex offers a limited number of base currencies compared to other brokers.

Trading accounts can only be denominated in three base currencies – EUR, USD, and RUB, which is limited compared to other brokers. Most other brokers denominated accounts in at least five to ten currencies. Additionally, InstaForex does not offer AUD trading accounts, which is a disadvantage for Deutschs who will likely have bank accounts denominated in AUD, and who will have to pay currency conversion fees on deposits and withdrawals.

For traders that trade in large volumes (more than 10 lots a month), it is better to open an account denominated in USD at a digital currency bank, especially for trading on assets such as the EUR/USD. This is because when trading a USD quoted currency pair with an AUD account, there will be a small conversion fee for every trade made.

Overall, InstaForex offers fewer trading account currencies than most other large international brokers and doesn’t offer accounts denominated in AUD.

Trading Platforms

InstaForex platform support is better than other similar brokers.

Alongside InstaForex’s two proprietary web-based platforms, it also offers support for MT4 and MT5, the two most popular trading platforms in the Forex industry.

InstaForex WebTrader: Designed by InstaForex, the user-friendly WebTrader trading platform is available only to the broker’s clients. WebTrader enables investors to trade directly in a web browser, so there is no need to download and install any software. This platform offers access to all the latest Forex news and analysis and synchronises with all other InstaForex platforms, allowing for multi-platform trading.

InstaTick Trader: InstaTick Trader is an in-house trading platform developed by InstaForex. Its key advantage is 6-digit quotes. Most platforms only offer 5-digit quotes, so the InstaTick platform provides traders with an even more detailed overview of the tiny fluctuations in the Forex market. InstaTick is available in a web browser with no downloads required.

MetaTrader 4 – The MT4 trading platform is the most widely used Forex trading platform and can also be used to trade other instruments like commodities, cryptocurrency, stock index, and stock CFDs. Though it is now showing its age, MT4 is still immensely popular for its auto trading features that enable algorithmic trading and strategy backtesting with expert advisors (trading robots).

Features of InstaForex’s MT4 platform include:

-

30 technical indicators

-

31 graphing objects

-

Three chart types

-

Nine timeframes

-

One-click trading.

-

Traders can also add custom EAs and indicators.

While MT4 has great customizability, the platform feels outdated, and some of the features may be hard to find. In addition, only the basic orders are available, including Market, Limit, Stop, and Trailing Stop.

MetaTrader 5 – The MT5 trading platform is being adopted by more Forex brokers all the time, it has a more modern interface, allows for an unlimited number of charts to be used, shows Depth of Market, and has a built-in Economic Calendar. It also has a larger number of pending order types than MT4 and features an embedded chat system. In addition, the MQL5 scripting language is more efficient than its precursor and MT5 has more advanced charting tools than MT4. Note that traders can only trade currencies, stocks, and metals on MT5 (for a full list of financial instruments, click here). Features of Instaforex’s MT5 include:

-

30 technical indicators

-

31 graphing objects

-

Three chart types

-

Nine timeframes

-

One-click trading.

-

Traders can also add custom EAs and indicators.

The benefit of InstaForex offering third-party platforms such as MT4 and MT5 is that traders can take their own customised version of the platform with them should they choose to migrate to another broker. Additionally, there are thousands of plugins and tools available for the MetaTrader platforms.

Overall, InstaForex’s platform support is better than other similar brokerages, and it offers its own proprietary trading platform which is easier to use and set up than MT4 and MT5.

InstaForex’s Mobile Trading

InstaForex’s mobile trading support is excellent compared to other similar brokers, but there is no mobile solution for MT5, Instatick, and the Webtrader.

InstaForex offers a range of downloadable apps, available on both Android and iOS. However, there is no mobile MT5 InstaForex trading server. Additionally, Webtrader and Instatick are only browser-based.

InstaForex offers the following mobile applications:

- MT4: The MT4 mobile application offers full InstaForex account functionality to offer a seamless transition from the desktop application. It is available on both Android and iOS. However, traders should be aware that it may vary in the number of technical indicators and instruments available to trade and has different chart types and market analysis tools compared to the desktop version.

- InstaVerify: This app enables you to verify your trading account on a mobile device.

- IFX Client: IFX Client allows safe and convenient access to the Client Area.

- IFX Partners: Provides clients with information on the account balance, latest transactions, and the amount of commission and rebate payments added to their account.

Trading Tools

InstaForex offers a host of useful trading tools to help traders make better trading decisions.

InstaForex offers a number of trading tools, including a VPS hosting service, a copy trading platform, various indicators, and educational resources.

- VPS: VPS hosting only runs on Windows OS. The Virtual Private Server enables you to upload and run your MT4 Expert Advisors and cAlgo Robots 24 hours a day, without needing to keep your trading terminal running. Available for free for accounts with balances over 5000 USD, VPS services are provided by a third-party, Beeks FX VPS. VPS services have the advantage of never suffering connectivity issues and have extremely low latency due to their proximity to major international exchanges. See below for more details:

- ForexCopy: The ForexCopy mobile app will help you explore the process of copying orders of top traders and start making money on their successful trades.

- Forex Signals: The Forex Signals app helps you conduct analysis and react to market developments promptly.

- Forex Strategies: By installing this application, you get access to trading strategies that allow you to gain additional experience and extend profits.

- Forex Quotes and Analysis: This app helps traders to make sound decisions while trading on Forex. The Forex Quotes and Analysis app enables you:

- To get quotes online

- To stay abreast of upcoming events with an economic calendar

- To read financial news provided by leading news agencies

- To analyze market conditions

- To monitor the latest macroeconomic reports

- To analyze the dynamics of quotes on charts

- To receive analytical reviews from forex experts.

-

Crypto Learn: This app allows traders to explore and learn about the cryptocurrency market.

-

PAMM: InstaForex’s PAMM service allows traders to invest in proven strategies executed by expert traders and take a share of the profit. Benefits of using the PAMM system include:

- Real-Time Data updates, where followers can observe the status of their investments.

- Advanced analysis tools for expert traders to improve their trading performance.

- No hassle – no trading experience is needed to open a follower account.

Overall, InstaForex provides a decent selection of trading tools.

Financial Instruments

InstaForex offers an average range of trading instruments compared to its competitors, but its Forex offering is impressive.

InstaForex offers trading on Forex, oil & gas, indices, shares, commodities, cryptocurrencies, metals, and futures.

-

Forex pairs: InstaForex offers 110 Forex pairs to trade, a much broader range than is offered by most other brokers. These include majors, minors, and exotics such as USD/ZAR and ZAR/JPY. Maximum leverage is 1:1000, however, only 17 pairs available on MT5.

-

Commodity Futures: InstaForex offers trading on 53 commodity futures, including metals, energies, and agriculture, a much broader offering than most other brokers. Maximum leverage on commodities is up to 1:100, but trading is not available on MT5.

-

Stock CFDs: InstaForex’s stock CFD offering is average compared to most of its competitors, with only 83 stock CFDs available to trade, including popular US tech companies, and those listed on the NASDAQ and NYSE, and more. Traders should note that stock CFD trading is only available on MT5. Stock CFDs are generally traded without leverage.

-

Indices: Instaforex offers cash and futures contracts on over 15 international indices, including the NASDAQ, S&P500, FTSE100, and the Nikkei. This is an average range of indices compared to other brokers. Maximum leverage is 1:100, but these are not available on MT5.

-

Metals: InstaForex offers trading on 4 metals, which is average compared to other similar brokers. The maximum leverage is up to 1:100 on metals.

-

Oils and Gas: InstaForex offers trading on 17 energies, a wider range than is typically found at other brokers. The maximum leverage on this instrument is 1:100.

-

Futures: InstaForex offers trading on two US futures, which is average compared to most other brokers. Maximum leverage is unpublished for Futures. Trading is not available on MT5.

-

Cryptocurrencies: InstaForex offers a reasonably wide range of cryptocurrencies including Bitcoin, Bitcoin Cash, Ethereum, Dash Coin, Ripple & Litecoin. Leverage for trading CFDs #Bitcoin, #Ethereum, #Litecoin, #Ripple, Uniswap, Polkadot, Filecoin, Doge, Chainlink, Cardano, BCHUSD can be changed in the specified range depending on market conditions. Spreads on these currencies are variable and are significantly higher than Fiat currencies, but in line with other brokers.

Overall, Instaforex provides an average range of tradable assets, but it should leave most professional traders satisfied.

InstaForex for Beginners

While InstaForex does offer two Cent Accounts targeted at beginner traders, it is not a welcoming environment for those with little trading experience. A structured trading course is only made available once a live account has been opened, and the freely available education is limited in scope and poorly presented.

Education

InstaForex’s educational materials are good for those who open a live account, but the freely available educational materials are lacking.

InstaForex provides a good trading course for those who open a live account. Lessons cover the basics of Forex trading, how to use the Metatrader platforms, technical analysis, and fundamental analysis, among others.

The freely available educational materials comprise a small selection of videos and tutorials that cover key concepts, margin trading, technical analysis, swaps, futures, and currency pairs. The videos are short and to the point, but lack depth. It also offers a number of written materials explaining the basics of Forex trading, but better materials can be found at other brokers.

Market Analysis

InstaForex’s market analysis is extensive, frequently updated, and useful for traders.

Market analysis, on the other hand, is updated daily by the InstaForex team. It is detailed and precise and presented in both video and text format. The research is divided into multiple topics, including Stock Markets, Hot forecast, Trading Plan, cryptocurrencies, For beginners, Video Analytics, and Pattern Graphix. Navigating through the research is simple, and the research is frequently updated.

Overall, InstaForex’s market research is impressive compared to what is typically available at other brokers.

Customer Support

Customer service available in 18 languages, including Bahasa Melayu and English, via email, live chat, Skype, and a responsive call-back service. Technical support is also available via several messaging services such as WhatsApp, Telegram, and Viber.

Technical support is available 24/5, while client relations is available from 08:00-17:00 (UTC +00).

For the purposes of this review, we found the customer support mostly responsive, but unable to answer some of our questions. For example, they could not give us a breakdown of the leverage associated with each financial instrument.

Evaluation Method

We value transparency and openness in the way we review the partners. To bring transparency to the forefront, we have published our review process that includes a detailed breakdown of the InstaForex product offering. Central to that process is the evaluation of the reliability of the broker, the platform offering of the broker and the trading conditions offered to clients, which are summarised in this review. Each one of these is graded, and an overall score is calculated and assigned to the broker.

Risk Statement

Trading Forex is risky, and each broker is required to detail how risky the trading of Forex CFDs is to clients. InstaForex would like you to know that: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 78.24% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Overview

InstaForex is a well-regulated market maker broker with four live accounts that all have identical trading conditions. While spreads are fixed, trading costs are significantly higher than other brokers. Additionally, Instaforex’s minimum deposits are low, which in combination with the high leverage (up to 30:1), could see trading accounts wiped out.

InstaForex offers a large range of tradable assets, including over 110 forex pairs on MT4, MT5, and two proprietary platforms. It also offers numerous trading tools to help traders make better trading decisions. While education is limited compared to other large international brokers, market research is extensive, frequently updated, and detailed.

Redaktionsteam

Chris Cammack

Leiter Inhalt

Chris kam 2019 zum Unternehmen, nachdem er zehn Jahre lang in den Bereichen Forschung, Redaktion und Design für politische und finanzielle Publikationen tätig war. Aufgrund seines Werdegangs kennt er sich mit den internationalen Finanzmärkten und der Geopolitik, die sie beeinflusst, bestens aus. Chris hat ein scharfes Auge für die Redaktion und einen unersättlichen Appetit auf aktuelle finanzielle und politische Themen. Er gewährleistet, dass unsere Inhalte auf allen Seiten die Qualitäts- und Transparenzstandards erfüllen, die unsere Leser/innen erwarten.

Alison Heyerdahl

Senior Finanzredakteurin

Im Jahr 2021 kam Alison als Autorin zum Team. Sie hat einen medizinischen Abschluss mit Schwerpunkt Physiotherapie und einen Bachelor in Psychologie. Ihr Interesse am Forex-Handel und ihre Liebe zum Schreiben hat sie jedoch dazu gebracht, den Beruf zu wechseln. Sie verfügt nun über mehr als acht Jahre Erfahrung in der Forschung und Inhaltsentwicklung. Bislang hat sie über 100 Broker getestet und bewertet und kennt die Welt des Forex-Handels in- und auswendig.

Ida Hermansen

Finanzredakteurin

2023 kam Ida als Finanzredakteurin zu unserem Team. Sie hat einen Abschluss in Digitalem Marketing und einen Hintergrund in Content Writing und SEO. Zusätzlich zu ihren Marketing- und Schreibfähigkeiten interessiert sich Ida auch für Kryptowährungen und Blockchain-Netzwerke. Ihr Interesse am Krypto-Handel führte zu einer größeren Faszination für die technische Analyse von Devisen und Preisbewegungen. Sie entwickelt ihre Fähigkeiten und Kenntnisse im Forex-Handel ständig weiter und beobachtet genau, welche Forex-Broker die besten Handelsbedingungen für neue Händler/innen bieten.

Broker vergleichen

Finden Sie heraus, wie InstaForex im Vergleich zu anderen Brokern abschneidet.